The Southwest Idaho Chapter of NARPM recently published their Quarterly Rental Market Survey for the Boise Metropolitan Area. The purpose of this survey is to show vacancy and rental rate trends among single-family homes and multi-family units in both Ada and Canyon Counties. Survey results are displayed by type (single or multi-family unit) and number of bedrooms (1-bedroom to 5-bedroom units) for the respective county.

The survey participants were property management companies affiliated with the Southwest Idaho Chapter of NARPM and are considered to be a representative sample of the inventory of professionally managed rentals in both Ada and Canyon Counties. Market status was surveyed as of December 31st, 2017, with over 7,500 rental units represented in the survey. The findings reveal the following market conditions:

Both Ada and Canyon county vacancy rates increased slightly reaching 3.3% for Q4 2017, up from 2.5% in Q3 2017. Overall, the largest vacancy increase was in multi-family units in Ada County which increased 1.3% this quarter. The second largest increase in vacancy rates was Canyon County multi-family units which increased slightly by only 0.8%.

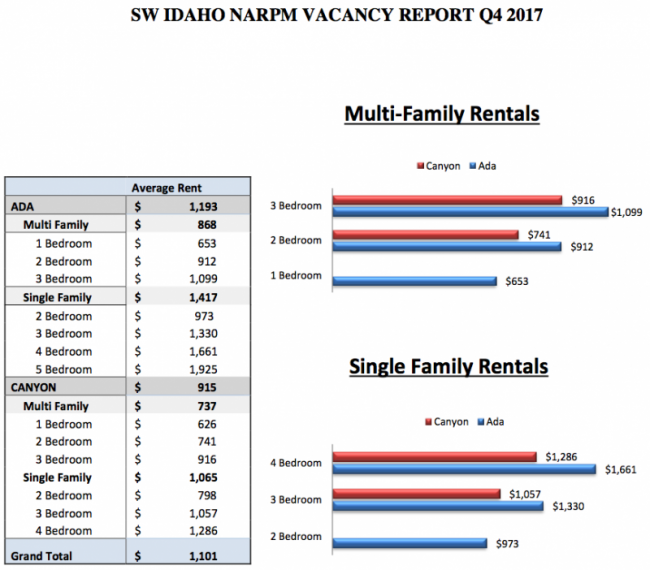

In Ada County, single family rental rates increased an average of $128 per month. A small number of larger, 5-bedroom homes with monthly rent averaging over $1900 contributed to this increase. Multi-family rental rates decreased an average of $48 per month from last quarter. This could possibly be due to the widespread increase in new multi-family units coming on market but this does not seem to be a trend at this point. Overall, with single and multi-family units combined, there was an average increase in rental rates of $53 per unit, making the average rent equivalent to $1,193 per month in Ada County.

Canyon County combined single and multi-family rental rates decreased by $13 overall putting the average rental rate at $915 per rental unit. Single family homes in Canyon County decreased in monthly rental rates by an average of $137 while multi-family units decreased by $20 per unit. Again, while we saw some decrease here, this does not seem to be an ongoing trend.

Overall, rates are still aggressively tracking in the Boise Metropolitan Market. We attribute the slight decrease in rental rates to multi-family overbuild in the market but primarily to the seasonality of the rental industry. There is a typical softening on rental price in Q4 and Q1 as opposed to Q2 and Q3 generally. We anticipate a strong rental market for spring and early summer with increased pressure on multi-family units. This can be attributed to the strong single-family home sales which rendering multi-family units a critical alternative rental option.

To learn more about proactive and trustworthy property management, please contact Beech Tree Property Management and learn how we can make your investment property perform to its highest potential. Please visit www.BeechTreeManagement.com or call (208) 484-4801.

– Compiled by Cory R. Tanner, Owner, Beech Tree Property Management, Cory@BeechTreeManagement.com.