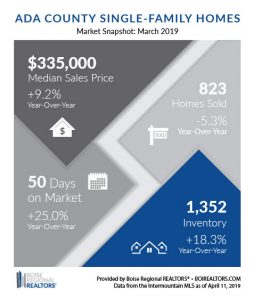

Single family home sales continue to keep pace as evidenced by the latest Intermountain MLS real estate report for March 2019. The data provided in the report shows an increasing median sales price of $335,000 for single family homes. This is up over 9% from last year. This median price is pushed up in large part because of the price of new homes. The increase in home prices has an ancillary affect on the rental market in the valley.

Due to increasing home prices, many renters are unable to qualify for home ownership. Even in the case of a dual income household, the increasing home prices are not allowing for home purchases by some tenants. Tenants are, consequently, forced to wait out the market, or hope for corresponding increases in wages, neither of which seem to be viable options.

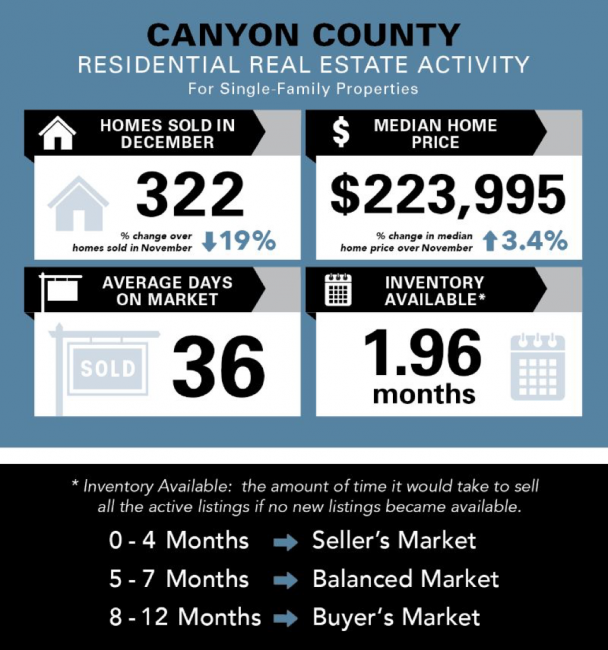

Part of this increase is due to the lack of inventory currently available to home buyers. Inventory for March sat at around 1,352 which remains very low. Inventory is expresses in terms of months of inventory when it comes to home purchasing. A healthy market enjoys an MSI (Months Supply of Inventory) of around 4-6 months. The latest March report showed an MSI in Ada County of 1.3.

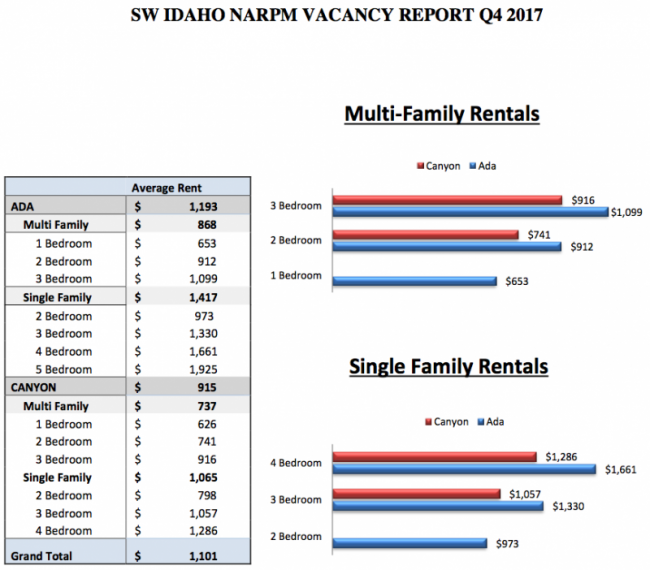

With a lower MSI, would-be buyers do not have available homes to choose from. This dynamic adds increasing rent price pressure on rentals, especially on single family homes. For investors, who own single family homes, the market is so good that many are electing to step out of being landlord in order to capture the market equity of their rental property. This, in turn, reduces the number single family rentals on the market which further drives up the demand and price of single family rental homes.

The bottom line is that the local market continues to be favorable for real estate sellers and continues to put pressure on would-be real estate buyers and tenants. The question moving forward will be what does the market look like for the immediate few months moving into the summer months. We anticipate that the market will continue with this trend through the end of this year.